The Economic Consequences Of Major Hurricanes

The Economic Consequences of Major Hurricanes

Introduction

Major hurricanes can have severe consequences not only for the individuals and communities directly impacted but also on the economy as a whole. Hurricane damage can lead to economic losses in a variety of ways, including property damage, destruction of infrastructure, and loss of business revenue. In this article, we will explore the economic consequences of major hurricanes and what steps individuals and communities can take to mitigate their impact.

Impact on Property

Property Damage and Insurance Claims

One of the most direct impacts of hurricanes on the economy is the damage caused to property. Hurricanes can cause extensive damage to homes, businesses, and other structures through high winds, heavy rain, flooding, and storm surges. This damage leads to significant insurance claims and payouts from both public and private insurers.

For example, following Hurricane Harvey in 2017, which caused widespread flooding in Houston, Texas, insurance companies paid out over $19 billion in claims to affected policyholders. The total cost of the hurricane was estimated at over $125 billion, making it one of the costliest hurricanes in U.S. history.

Impact on Real Estate Market

Hurricanes can also have an impact on the real estate market in affected areas. Following a major hurricane, property values may decline as a result of the damage and uncertainty about future storm risks in the area. Some homeowners may choose to sell their damaged properties, while others may struggle to make necessary repairs or rebuild entirely. This can result in a slowdown in the local housing market and possibly even a broader regional economic downturn.

Infrastructure Damage

Hurricanes can also cause significant damage to infrastructure, including roads, bridges, power lines, and other vital systems. This damage can disrupt transportation and communication networks, leading to lost productivity and economic activity. For example, Hurricane Katrina in 2005 caused extensive damage to the levee system in New Orleans, resulting in widespread flooding and significant long-term economic repercussions in the region.

Impact on Businesses

Loss of Revenue

Hurricanes can also have a substantial impact on local businesses, particularly those in areas directly affected by the storm. Businesses may be forced to close temporarily or even permanently due to the damage caused by the hurricane. Even businesses that remain operational may experience disruptions in supply chains, transportation, and communication, leading to lost revenue and decreased economic activity.

Business Insurance Claims

Many businesses affected by hurricanes will have insurance coverage to mitigate some of the financial impact. Business insurance policies typically cover property damage, business interruption losses, and other costs associated with the hurricane. However, the process of filing and receiving insurance payouts can be time-consuming and complex, leading to further economic disruption for impacted businesses.

Small Business Impact

Small businesses may be particularly vulnerable to the economic consequences of major hurricanes. According to the Federal Emergency Management Agency (FEMA), up to 60% of small businesses never reopen after a disaster like a hurricane. This can have significant consequences for local economies and job markets.

Impact on Government Finances

Disaster Relief Spending

The economic consequences of major hurricanes can also impact government finances at the local, state, and federal levels. In the aftermath of a hurricane, governments may need to spend significant sums on disaster relief, including emergency services, debris removal, and infrastructure repairs. These expenses can quickly add up and strain already tight government budgets.

Loss of Tax Revenue

Additionally, the economic impact of hurricanes can lead to a decline in tax revenue for affected governments. Businesses that close or suffer losses may pay less in taxes, while individuals who lose their jobs may have lower incomes and pay less in income taxes. This can exacerbate financial strains on local governments already dealing with disaster relief expenses.

Taxpayer-Funded Insurance Programs

In addition to direct spending on disaster relief efforts, governments also often operate taxpayer-funded insurance programs to help mitigate the financial risks of hurricanes. For example, the National Flood Insurance Program provides insurance coverage for homeowners and businesses located in flood-prone areas. However, these programs can be costly to operate and may require significant government subsidies to remain viable.

Frequently Asked Questions

-

Can hurricanes cause long-term economic damage?

Yes, hurricanes can cause long-term economic damage through property damage, infrastructure destruction, loss of business revenue, and other factors. The impact can be particularly severe in areas where hurricanes are a recurring threat.

-

What steps can individuals take to mitigate the economic impact of hurricanes?

Individuals can take steps such as purchasing hurricane insurance, securing their property before the storm, and keeping essential documents and supplies readily available. Additionally, communities can work together to strengthen infrastructure, improve disaster preparedness plans, and advocate for government support in the aftermath of a major storm.

-

How do hurricanes impact the real estate market?

Hurricanes can impact the real estate market by lowering property values in affected areas due to the damage and uncertainty about future storm risks. Some homeowners may sell their damaged properties, while others may struggle to make repairs or rebuild, leading to a slowdown in the local housing market.

-

What is the National Flood Insurance Program?

The National Flood Insurance Program is a taxpayer-funded insurance program that provides coverage for homeowners and businesses located in flood-prone areas. It is designed to help mitigate the financial risks associated with flooding and other storm-related damage.

-

How can small businesses be impacted by hurricanes?

Small businesses may be particularly vulnerable to the economic consequences of major hurricanes. Many small businesses never reopen after a disaster, leading to job losses and decreased economic activity in affected areas.

Conclusion

Major hurricanes can have severe economic consequences, affecting individuals, businesses, and governments at all levels. The impact can be particularly severe in areas where hurricanes are a recurring threat, such as coastal regions. However, there are steps that individuals and communities can take to mitigate the impact of hurricanes, including purchasing insurance, securing property before the storm, and advocating for government support. HurricaneInsider.org provides valuable resources and information on preparation, safety during a storm, and post-hurricane recovery efforts. By working together and taking proactive steps, we can help minimize the economic impact of hurricanes on our communities.

Thank you for taking the time to read this article, and we encourage you to share your thoughts and experiences in the comments section below. For more information and resources on hurricanes, visit HurricaneInsider.org.

Additional Resources

- Business Impact Analysis - Ready.gov

- Federal Emergency Management Agency (FEMA)

- National Hurricane Center - NOAA

Hurricanes And Mental Health: The Psychological Impact

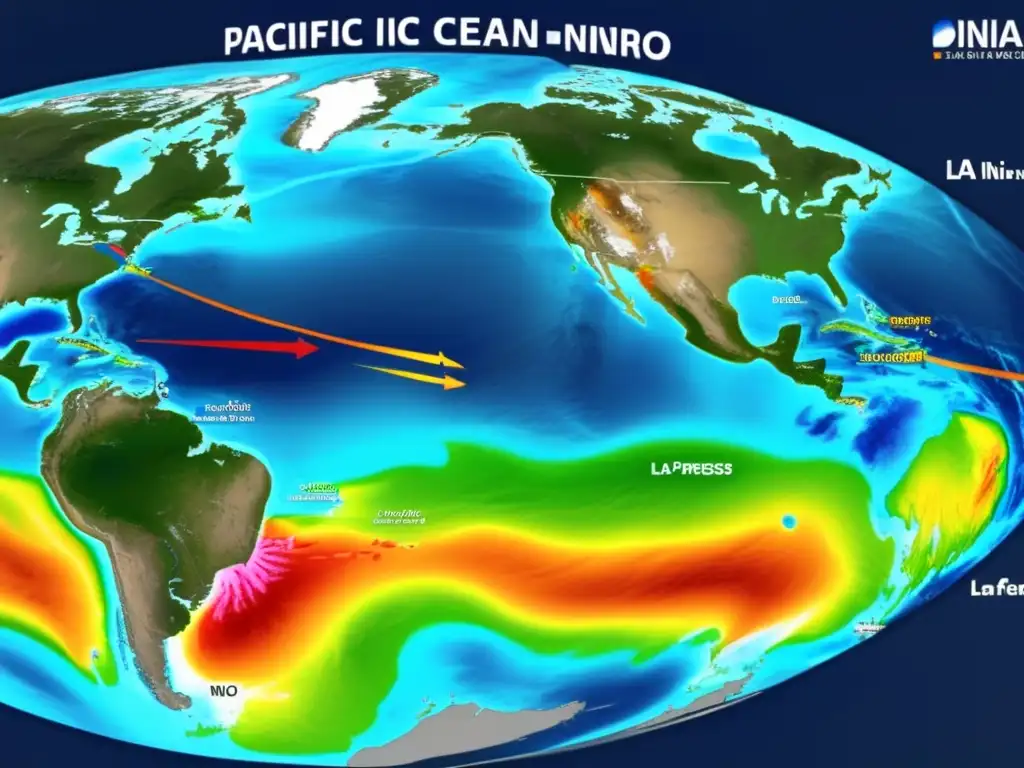

Hurricanes And Mental Health: The Psychological Impact El Niño And La Niña: Influences On Hurricane Activity

El Niño And La Niña: Influences On Hurricane Activity Cyclones, Typhoons, And Hurricanes: Different Names, Same Phenomena

Cyclones, Typhoons, And Hurricanes: Different Names, Same PhenomenaIf you want to discover more articles similar to The Economic Consequences Of Major Hurricanes, you can visit the Basic knowledge about hurricanes: category.

Leave a Reply

Articulos relacionados: